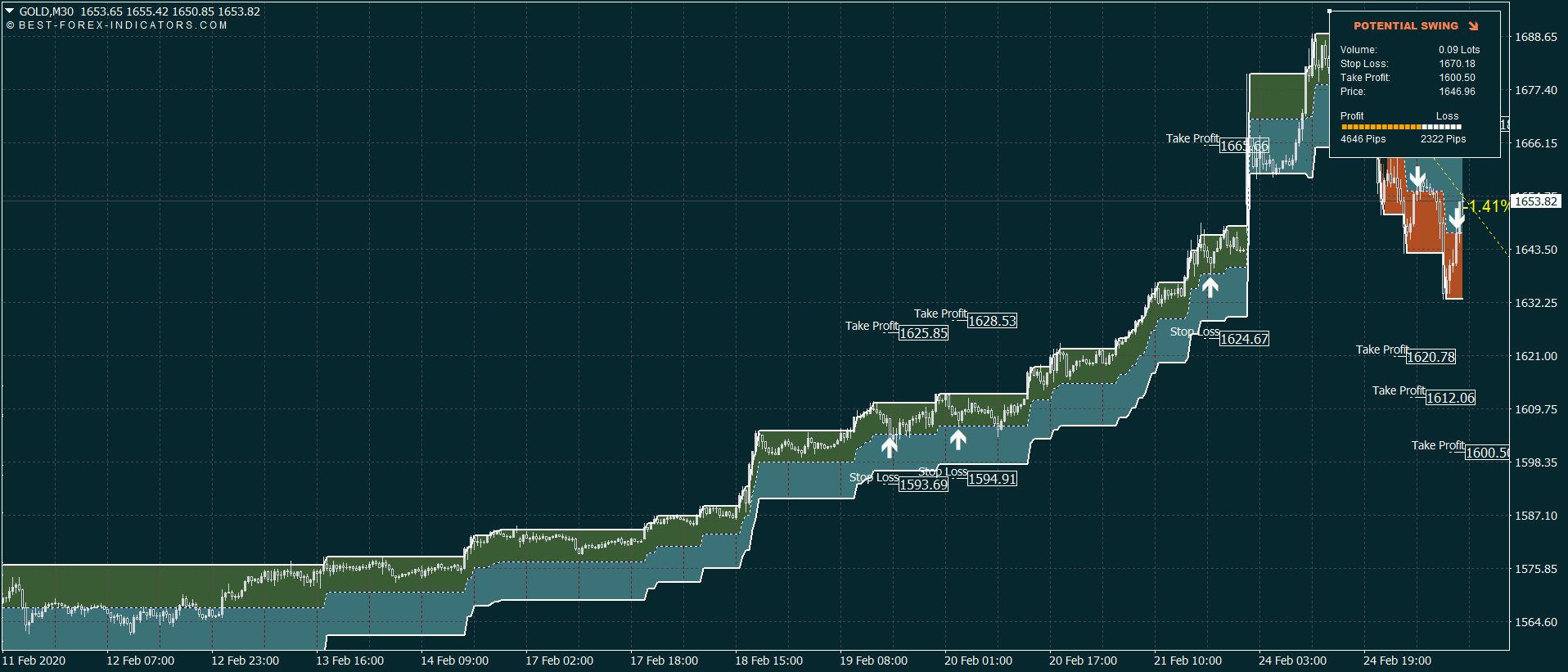

The size of your gain is the distance between your entry points at the profit level. The next step is to identify the profit level which would be your profit level. For greater results, you should plan an entry while the price candle is formed in the uptrend after the dip and should place the Stop Loss limit at the lowest point of the next pullback. One is successfully entering the market and the second is isolating the lowest point of the pullback in order to prevent stop loss.

These are dependent on two things in a bullish market.

The swing traders make use of these short-term dips and rise into proper use. What happens during a bullish market is that the stocks move up in a gradual manner even though there are temporary pullbacks during the upward rising. Swing traders try to play with the trend on a rallying market. Success in swing trading depends on identifying the correct impulses going on the market. During the movement of the stock, the traders will have many opportunities to make a profitable trade. This will rise and fall like a wave for a certain period of time. The indexes will only move in a pattern in a stable market unless there is a bearish or bullish fluctuation. For the same reason, swing traders prefer a stable market where the indexes will only move within a range for at least a few days to weeks. Due to this, the stocks may not swing as they do. They do so because when the market condition is extreme the most active stocks may behave unpredictably. Swing traders in India prefer to trade in a moderate market condition than trading in a bearish or bullish market. The trade will ride from in one direction for a couple of days or weeks and switch the positions to the opposite side of the trade when the direction is reversed. The stocks will swing from one extreme to a low extreme. On the major exchanges, they are the ones who are actively traded. It is always best to choose large-cap stocks as they are the best candidates. This is the first and foremost step is to pick the right stock. Now that we have an idea of what Swing trading is, the next biggest step is to choose the best stocks that will be profitable. And of course, be aware of the risk factors involved. You just have to check if the money is flowing into the stock or if the money is flowing out. Here you make the decision and choose the stock solely based on the law of supply and demand. What makes Swing traders stand out is that they do not have to care about the fundamentals, of the company, the kind of product they are selling, and weirdly enough even the name of the company. This type of trading is suitable for people with a job because you need not devote all your time to it. This time period is usually between the two extremes while they trade the stock depending on its intra-week or intra-month oscillations. Swing traders in India hold on to a particular stock for a time ranging from a day to two weeks, generally. Swing traders sit midpoint of the two extremes. Picking up the right stock is very essential to be successful at Swing trading. Most fundamentalists prefer this method of trading to any other method. The duration of the swing trade can extend up to a week or two. Swing trading is a fundamental form of trading. The trade is usually in the direction of the trend. They usually target a larger share of the market and wait until they have a perfect deal. Unlike Day traders, Swing traders do not need to square off their share within the same day. Swing trading is very different from day trading as intraday traders only hold their share only for a short period of time. For this same reason, many traders use the Swing trading method to trade. Due to this reason, it takes some time to render a significant profit. Price movements generally take several days and in some cases, even weeks to cause price movements. Swing trading is a kind of fundamental trading where the positions are held by the trader for longer than a day. Swing trading is one such method of trading that is used commonly for trading. Trading style may differ from person to person and depending on the investment goal of the individual. People choose to trade their money using different methods that suit their trading style and their comfort. In the field of the Stock market, shares are traded using different methods every day.

0 kommentar(er)

0 kommentar(er)